In order to thrive through changing business cycles, there is a delicate balancing act taking place within organizations to keep human capital and employee engagement goals aligned with spending responsibility and revenue achievement. Planned and forecasted properly, organizations can remain in a proactive state with time to model out a variety of scenarios to determine the best course of action for their people, and the business as a whole. Without proper planning and collaboration, companies will forever be pushed or pulled in the direction of yesterday’s market changes, forcing them to react impulsively to correct their course. At the ends of this scale, maintaining this vital balance are two departments: Human Resources and Finance.

These departments have many overlapping goals and deliverables, such as:

- Keeping staffing levels and compensation spending controlled to support business growth or consolidation scenarios

- Evaluating the budgetary and cash flow implications of maintaining current staffing levels if monthly revenues are projected to decline

- Projecting budget and headcount adjustments to put the organization in the best possible position for the new normal

- Forecasting the proper hiring plan and staffing levels when growth resumes

- Determining which roles are most critical to business continuity and mapping out which roles provide the supply chain for other roles. For example, the Sales Executive role may be deemed critical to business, and it would be helpful to understand what percentage of your internal entry-level sales personnel are promoted to Sales Executive positions.

- Maintaining employee engagement and retention through it all by properly planning for and communicating career progression and growth opportunities to existing staff

- Managing learning and development investments and adjusting pay levels to align with compensation philosophy and succession planning

Unfortunately, there is typically a lack of alignment between HR and Finance. Most organizations do not have the agility or planning processes in place to get all stakeholders working together in time to accurately correlate people and financial data into actionable workforce plans that represent both the current state and modeled variations of it. In fact, 76% of HR leaders and 55% of Finance leaders believe that workforce planning is their responsibility, and only 28% of these leaders have shared reporting and modeling systems. In the current market, many leaders are completely in the dark because of the speed and frequency that CFOs have been re-forecasting. As a result of more erratic forecasting, especially during planning cycles impacted by COVID, a lot of Finance teams have been disconnected with HR Business Partners.

Here are four ways to foster this crucial relationship during times of constant change:

1. Develop an Agile Collaboration Process to Accelerate and Improve Decision Making

Set a weekly or bi-weekly recurring conference between your primary stakeholders in Finance and HR. To get started, this meeting may just be between your CHRO and CFO, or VPs of Finance and HR. To foster better relationships, respect, and collaboration, a video call would be best. I would also recommend inviting other support staff that will help carry out your people and financial strategies, such as your recruiting leaders and financial managers. You may choose to put them on the invite as optional so the time is carved out on their calendars and involve them when you anticipate a change in the current strategy. Through this process, you are identifying this partnership as critical to the business and setting the tone for continuous collaboration and relationship building.

2. Develop a System of Organizing and Sharing Your Pertinent People and Financial Data

In building a productive and fruitful relationship, data is the domain commodity that will build the bridge of understanding between the two departments. To get started quickly, you might convert your existing reports to a Google Sheet or move it to a shared drive so all meeting participants have access to your latest and greatest reports. For reporting, I would recommend one central source or tool for your data. Having to guide team members outside of your area of expertise on a suite of reports they’re not familiar with will be time consuming and difficult to follow. To achieve understanding, simplicity and centralization are vital.

Preparing HR Data for Finance

Some of the HR data you will want to have prepared for your meetings with Finance are:

- Time to fill - A measurement of time between when the requisition was approved (or opened) and when it is filled. It can give a high level understanding of how long it will take to fill a given role.

- Time-to-hire - A measure of time between when a candidate applies to an opening and when they are hired. This can highlight how quickly you run your recruiting process for a given role.

- Effective ramp times by role - A measurement of the time it takes for a new employee to become a fully productive member of the team.

- Turnover by role - The rate of time to which employees leave a given position.

- Average tenure by role - The rate of time employees stay in a given position.

- Who is being managed up or out - This leverages the HR department’s business partnerships throughout the organization, and provides further insight into potential vacancies or existing succession plans.

- What positions have been filled and who is interviewing- This is recruitment process data to update on roles filled, the salaries, or expectations of upcoming fills and remaining recruiting time needed for given roles.

- Cost per hire - Total expenses for hiring divided by the number of hires. You will also want to track sources of your hires, the cost, and the return on your investment.

- Compensation and benefits costs - This encompasses the cost to the business of salaries, bonuses, and benefits for employees.

Preparing Finance Data for HR

On the Finance side, you will share information such as:

- Employee Lifetime Value (ELTV) - ELTV is more of a notional concept, but one that is gaining momentum in tracking and measuring within Finance and HR organizations. It represents an employee’s net value to an organization over time. This number is typically a negative number at the point of hire through onboarding and orientation, will be in the positive after fully ramping, and could continue to climb if the employee is exceeding expectations in their role. The ELTV curve may plateau or decline if upskilling doesn’t occur, an employee becomes disengaged, or the employee decides to leave.

- Forecasted cash on hand - Rather than spread annual amounts equally over 12 months as you would do in a profit and loss statement, you’ll record all cash inflows and outflows in the months that you incur them. Otherwise, you may project a profit for a given month but find yourself unable to cover all of your bills for lack of cash.

- Total Revenue - This is the value of the contract recognized during the period plus any one-time revenues from professional services or usage based charges.

- Gross Margin - Total revenue minus the cost of goods sold (COGS).

- Net Income - Total revenue minus expenses, interest, and taxes.

- Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) - Revenue less COGS and operating expenses. A measure of profitability that can be used to compare financial performance within an industry or group of companies since it shows earnings before the impact of a company’s unique financial deductions.

- Quota achievement -The performance of the sales team as a whole over a given period of time with breakdown to individual sales executives against quota objectives. This allows visibility of seasonal achievement in sales, and the ability to forecast success in the future and its impact on other financial metrics and hiring.

- Customer Acquisition Cost (CAC) - CAC is a SaaS company finance term. This refers to the cost of winning a customer and can be calculated by adding the costs spent acquiring customers divided by the total number of new customers in a given period.

- Annual Recurring Revenue (ARR) - ARR is also a SaaS company finance term. For subscription based product and service providers, ARR shows the total value of recurring revenue normalized over a year.

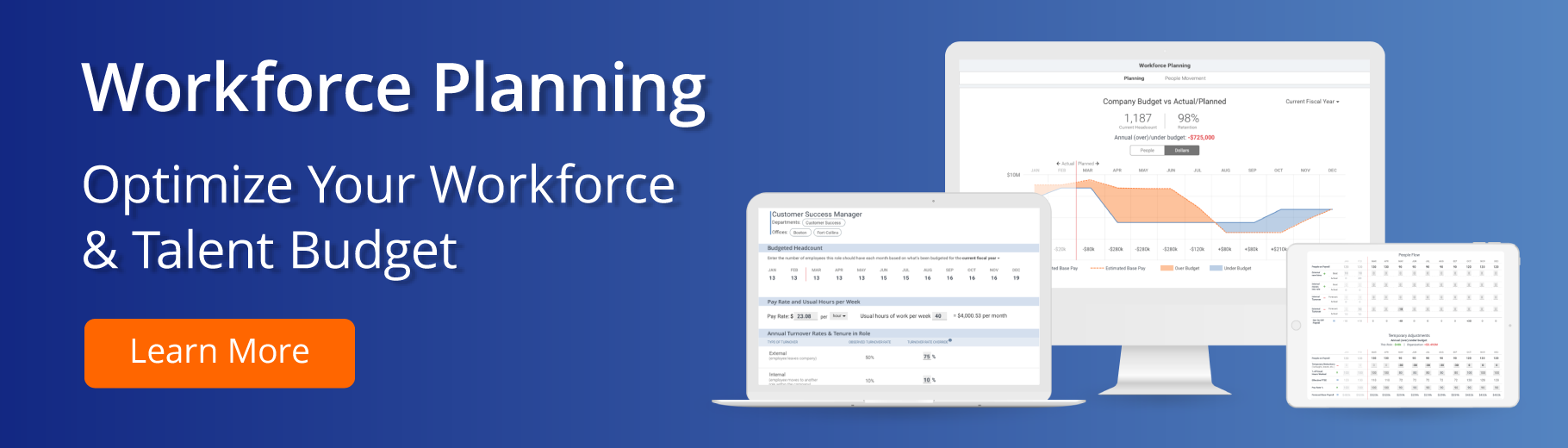

3. Invest in Good Talent Management and Workforce Planning Technology

Organizations that deploy workforce planning and analytics systems are 66% more likely to increase HR performance efficiency without increasing headcount. Without it, effective workforce planning can be difficult to achieve for the following reasons:

- Enormous Datasets and Variables. The volume of HR data and the complexity of roles and department structures make it impossible to understand and model all the factors influencing your talent picture with a manual process. More sophisticated and dynamic tools are required for strategic workforce planning in today’s rapidly changing world.

- Rapid and Unexpected Business Challenges. Talent forecasts and staffing priorities developed in spreadsheets quickly become obsolete. Companies must quickly adapt to a changing economic climate and optimize their organizational structure and staffing levels for alignment with the latest revenue and profit predictions. Those who can harness their organizational and employee data in real-time and leverage technology to collaborate and change assumptions will be better positioned to adjust financial and staffing plans with confidence to effectively manage their businesses going forward.

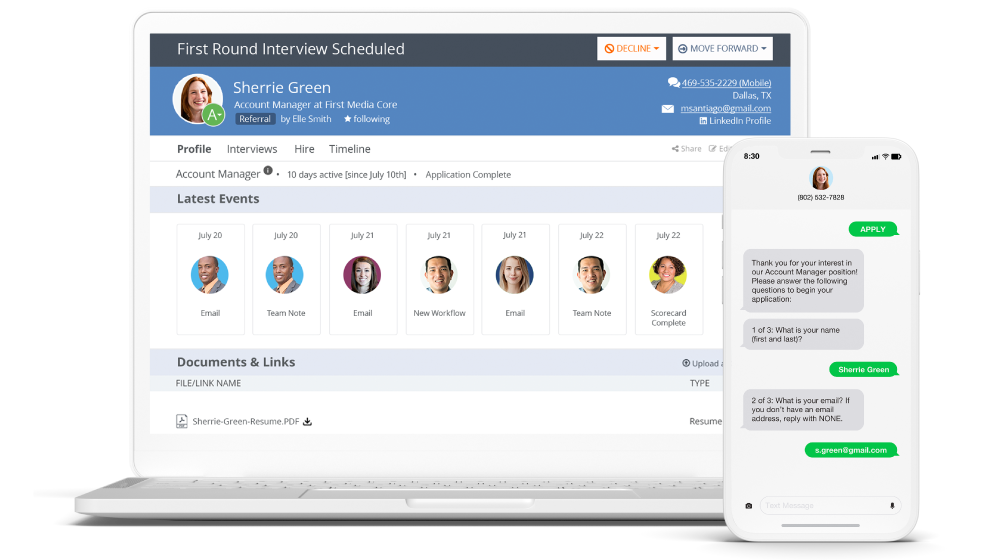

For planning precision and efficiency in execution, it would be wise to deploy a talent platform that can be customized to your hiring process and accurately analyzes and reports on relevant metrics to drive decision making quickly. These technologies combine to achieve the simplicity and centralization so vital to long term consistency and success in workforce planning.

4. Leverage your existing relationships for success

For HR to bring data on who is being managed up in a department, for example, or for Finance to understand if the business is positioned to hit it’s revenue targets, they must have strong relationships with leaders and hiring managers throughout the organization that keep them informed on the various states of the business. Cultivate these relationships, leverage this information to keep one another informed, and involve these outside stakeholders in the conversation when necessary. For example, invite your Director of Sales to a critical conversation between HR and Finance regarding new headcount allotment in Sales based on current cash, revenue achievement, employees still in a ramp period, and those on performance improvement. This will build a much more honest and collaborative relationship moving forward, versus just informing your Director of Sales of your findings after the fact and that she cannot hire anyone.

For more information on the ways the ClearCompany Workforce Planning solution helps you build a complete strategy for the future of your organization, reach out to our experts and schedule a free demo today.

.png)